Our Core Services

Factor Loans

Allows businesses to access financing based on the value of their accounts receivable. This type of financing can be a quick and flexible option for businesses that are looking to bridge cash flow gaps or fund growth.

Small Business Financing

Offers a wide range of financing options for small businesses, including bank loans, SBA loans, business credit cards, and online lending platforms. The right option will depend on the specific needs and financial situation of each business.

Business Planning

Provides strategic planning and customized action plans to help businesses achieve their goals. This includes market and competitive analysis, as well as financial projections and an implementation plan.

Tax Preparation

Ensures that small businesses are accurately and timely preparing their tax returns. This can help to minimize liability and ensure compliance with tax laws.

Tax Planning

Offers advice and strategies to help small businesses minimize their tax liability and maximize their tax savings.

Expert Advice

Our Core Features!

Why Choose Our Company

Empowering small businesses with the financing they need.

Expert Financing Solutions for Small Businesses

Comprehensive Business Planning Services

Expert Tax Assistance for Small Businesses

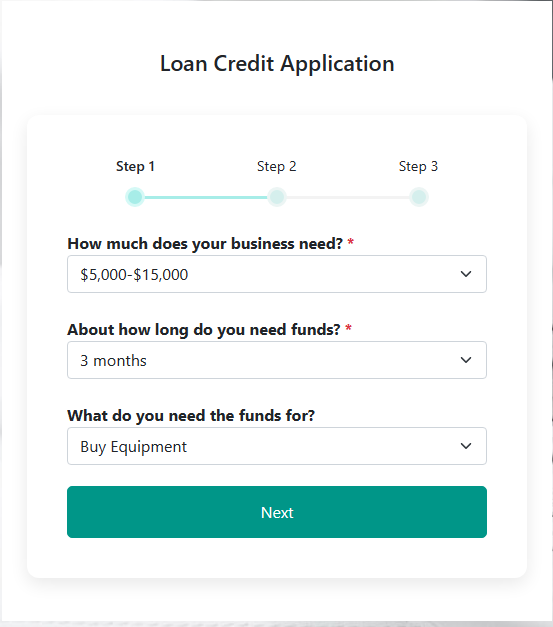

Get Your Loan In 3 Easy Steps

Get the loan you need with just three simple steps: 1) apply online 2) provide necessary documentation, 3) receive approval and funding

Select amount and terms

Enter your personal information